NZ Central Bank Cuts Rates, Signaling Global Easing Ahead

In a landmark decision that reverberated across financial markets, the Reserve Bank of New Zealand (RBNZ) made headlines this Wednesday as it announced a cut in interest rates for the first time in nearly four years. As a wave of easing monetary policies gains momentum globally, New Zealand joins the ranks of developed economies shifting into a more accommodating stance, further raising questions about the future economic landscape. Following last year's initiation of interest rate cuts in emerging markets, Switzerland stepped up as the first developed nation to follow suit in 2023, underscoring the growing urgency among central banks to address potential economic downturns.

During an August monetary policy meeting, RBNZ decided to lower its official cash rate by 25 basis points, bringing it down to 5.25%. This move highlighted the central bank's commitment to navigating the complex terrain of inflation and economic performance. According to their policy statement, inflation is expected to stabilize and return to the designated target range, albeit with a caution that rates will need to remain restrictive for some time. Speculation looms that further rate cuts could be on the horizon as the economic environment evolves.

Advertisement

Interestingly, prior to this announcement, New Zealand reported a year-on-year increase in its Consumer Price Index (CPI) for the second quarter at 3.3%, a notable mark below the RBNZ's anticipated 3.6%. This underscored growing pressure on the central bank to take decisive action in response to evolving economic indicators.

RBNZ Governor Adrian Orr characterized the interest rate cut as a “low-risk” decision, emphasizing confidence in inflation gradually returning to the central bank's target range of 1% to 3%. He expressed optimism, stating, “We are at a position where we can confidently expect inflation to return to the target range and begin to recalibrate policy rates.” Such statements echo a broader sentiment: the RBNZ’s reduction in CPI forecasts for the end of the year—from 2.9% to 2.3%—signals a significant policy shift aimed at bolstering the economy.

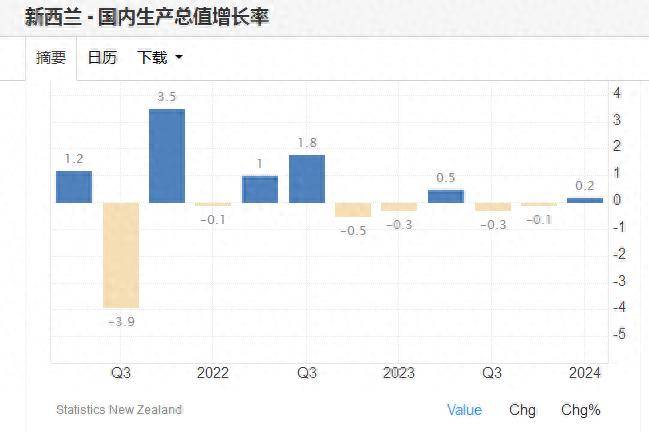

However, the tightening of money supply has intensified economic pressures, resulting in a technical recession and gradually rising unemployment over the past two years. The central bank's report aptly noted that the weakening of domestic economic activity has become more manifest and widespread, predicting a potential return to recession by year-end, with a gradual recovery expected from 2025 onwards. This sets the stage for unemployment rates to potentially rise to 5.4% by mid-next year, a concerning trend considering economic recovery aspirations.

Economists at Capital Economics forecast that New Zealand will embark on a more aggressive easing cycle than previously anticipated, with an emphasis on stimulating the economy as growth continues to wane.

As New Zealand navigates its interest rate adjustments, the implications stretch beyond its borders. The RBNZ's actions could herald a fresh wave of rate cuts from developed economies at large. With inflation rates slowly easing and signs of economic instability emerging, a consensus is forming that the Federal Reserve may likely also reduce rates in September. However, there is a prevailing divergence in policy outlooks, as markets pivot to focus on achieving a soft landing for the economy, a delicate balance during times of uncertainty.

Prominent economist Bob Schwartz from Oxford Economics highlights that while the U.S. economy shows resilience through service and consumer sector data, the Federal Reserve is likely to adopt a cautious approach, taking into account various indicators before committing to substantial rate cuts. A 25 basis point reduction could soon be deemed appropriate, but the risks associated with prolonged high rates warrant consideration.

Furthermore, market observers express concerns that the prolonged high-interest environment could inflict unnecessary harm on the economy. George Catrambone, the head of fixed income and trading at DWS, points to the historical tendency for delayed action leading to adverse repercussions, suggesting that the possibility of a soft landing remains but is fraught with uncertainty.

Across the Atlantic, following the European Central Bank's (ECB) decision to hold rates steady in August, speculation is rising around potential future cutbacks. The latest economic forecasts point to a downturn in growth projections, with inflation anticipated to continue its downward trajectory. After a brief improvement in the Eurozone’s economy in the second quarter, indicators suggest new challenges that may reinvigorate dovish sentiment among ECB policymakers, particularly as employment growth in the private sector stalls.

Moreover, Canada has also seen rate cuts in June and emphasizes the growing concerns about downward pressures on its economy. With the Bank of Canada acknowledging that the consumer market remains sluggish and labor dynamics indicate marked cooling, the need for policy ease seems increasingly critical.

Tiff Macklem, Canada’s central bank governor, remains hopeful that inflation will reach the target of 2% next year. The challenges arising from reduced consumer demand and increased economic slack add complexity to a path forward, necessitating that swift actions be taken to bolster the economy while achieving stability.

Interestingly, the Swiss National Bank (SNB) has also responded to shifting economic landscapes, reducing rates twice this year, with speculation surrounding further cuts in September due to pressure on the economy stemming from a strong Swiss franc. Exporters, particularly in manufacturing, voice urgency for timely intervention to mitigate economic detriment as heightened geopolitical tension contributes to heightened demand for safe-haven currencies.

The Bank of England, in its recent meeting, executed its first interest rate cut in four years but adopts a cautious stance regarding the pace of future reductions. The bank anticipates inflation to rise again due to the diminishing impact of falling energy prices, with long-term inflation dynamics, driven primarily by service prices, wages, and labor market tightness, remaining in focus.

Contrastingly, Australia finds itself in a different scenario, with interest rate cuts not on the immediate horizon. The Reserve Bank of Australia's recent decision to maintain rates highlights ongoing inflation above the target range, despite previous peaks. Michele Bullock, RBA Governor, conveyed a vigilant stance on inflation risks, asserting that robust demand requires continued monitoring. The bank remains prepared to raise rates if necessary, reflecting a more hawkish outlook amidst broader uncertainties.

As economic conditions evolve globally, the intertwined fates of these central banks signal a complex web of influence and responsiveness that shapes the financial landscape. While rates are likely to be manipulated in response to inflation trends and economic activity, the outcomes hang in a delicate balance awaiting further developments.